Mastercard Partners with Mercuryo to Offer Non-Custodial Crypto Spending Card

3 comments

KEY FACT: Mastercard has launched a euro-denominated crypto debit card in partnership with Mercuryo. This is to enable users to spend cryptocurrencies from self-custodial wallets at over 100 million merchants worldwide. Users will retain full control over their crypto, which eliminates the need for centralized exchanges. The card includes fees like a €1.60 issuance charge and a 0.95% off-ramp fee.

Image Source: Mercuryo

Mastercard Partners with Mercuryo to Offer Non-Custodial Crypto Spending Card

Mastercard, a global payment giant has partnered with Mercuryo, a London-based financial technology firm to launch a euro-denominated crypto debit card, to enable users to spend crypto directly from self-custodial wallets at over 100 million merchants in the Mastercard network worldwide. This partnership follows its earlier collaboration with MetaMask, showing Mastercard's commitment to self-custody in the crypto space.

This partnership allows users to retain full control over their crypto, thereby eliminating the need for centralized exchanges. This means that users can spend crypto while “being their own bank.” This is a significant step in integrating cryptocurrencies into mainstream payments. This marks an important advancement for those looking to manage and spend their crypto holdings without relying on centralized exchanges, to maintain full control over their digital assets.

The possibility of this card being used at more than 100 million merchants worldwide, is a bridge of the gap between traditional finance and blockchain technology. This means that crypto holders can use their digital assets as easily as traditional fiat currencies. Hence, Mastercard has successfully addressed one of the biggest barriers to crypto adoption—usability in daily life.

Securing the Mastercard-branded Spend card by Mercuryo incurs a €1.60 ($1.80) issuance fee and a €1.600($1.10) monthly maintenance fee. Also, an off-ramp 0.95% fee levied by Mercuryo applies. That notwithstanding, users who are keen on maintaining control over their digital assets see the fees as a small price for the added security and autonomy.

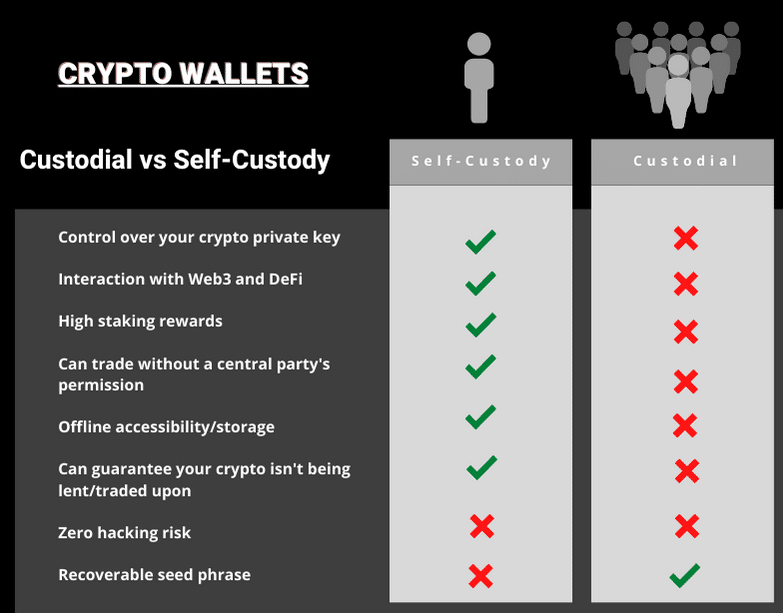

Self-custodial wallets versus custodial wallets. Source: Tastycrypto

The value of Mastercard's partnership with Mercuryo lies in understanding the value of self-custody. Self-custody is one of the core concepts of cryptocurrency that provides a method of storing assets without depending on any centralized platform, such as a bank or an exchange. In contrast to custodial wallets, self-custodial wallet users take full responsibility for securing their funds. They have sole custody of the private key that allows one to access the wallet.

Self-custodial wallets provide users with direct ownership of their private keys and funds. Christian Rau, Senior Vice President of Mastercard’s crypto and fintech enablement has applauded the firm’s collaboration with Mercuryo, stating that it will strengthen financial autonomy.

“At Mastercard, we are working closely with partners to innovate and enhance the self-custody wallet experience,”...“Through our collaboration with Mercuryo, we’re eliminating the traditional barriers between blockchain and conventional payments, providing consumers who want to spend their digital assets with an easy, reliable, and secure way to do so, anywhere Mastercard is accepted.”

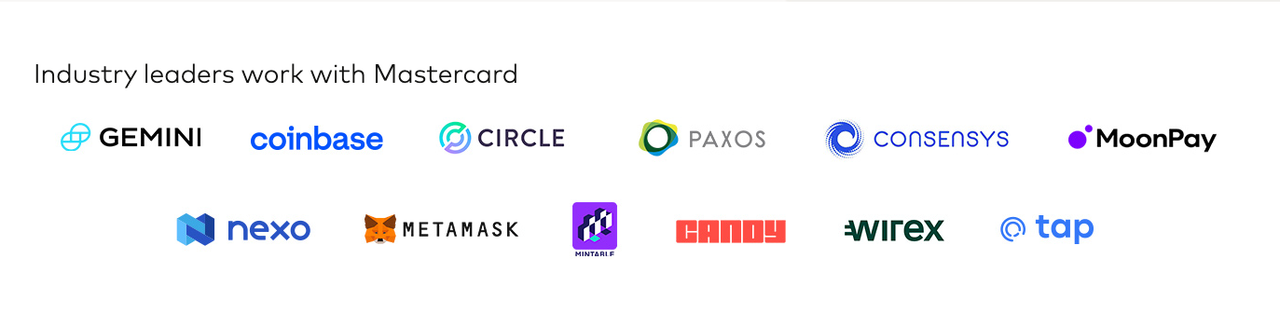

Mastercard’s Partners in the Crypto Industry. Source: Mastercard

With this integration, Mercuryo has joined the league of Mastercard's partners in the crypto industry which includes USD Coin provider Circle, major US-based crypto exchange Coinbase, and many others.

This development is another strategic project that will strengthen blockchain integration in traditional payments and crypto adoption. Having Fintech giants like Mastercard ahead of the game is quite encouraging. It is hoped that more related innovations and partnerships will be birthed.

Mastercard was founded in 1966 and operates an international payment card services corporation headquartered in the United States. It provides various financial services in more than 210 countries and territories.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha

Comments