Inflation is not going down without a fight

8 comments

.jpg)

All central bankers around the globe are highlighting how sticky this bout of inflation can be. And they are raising interest rates to control the red-hot inflated market. They are hoping that the annual rate of inflation will be down to the target zone of two percent. Looks like the bankers are right in labelling inflation as sticky.

Statistics Canada released Canada's recent Gross Domestic Product (GDP) data today. The Canadian economy is not slowing and that's bad in the context of what's happening with the interest rates.

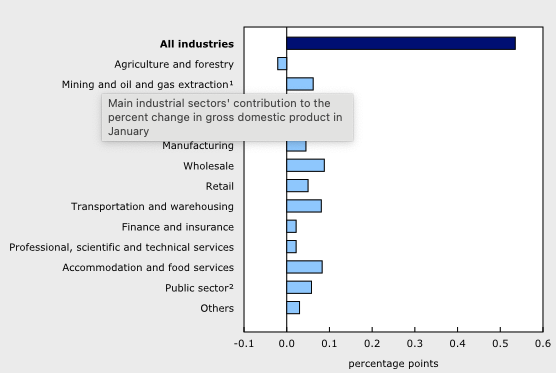

Real GDP rose 0.5% in January 2023 after a 0.1% contraction in December last year. Both goods-producing (0.4%) and services-producing (0.6%) industries were up in January.

------------------Statistics Canada

It looks like the construction industry is seeing a boom. The construction sector posted its largest gain (0.7%) since March 2022. Even other sub sectors that showed significant growth are somewhat related to the construction sector such as machinery, equipment and supplies, the manufacturing sector and the transportation sector.

It is so ironic when we are expecting the economy to slow down while we are also worried that we are going into recession. I have been following Canadian interest rate hikes and a number of other economic data for the last six months. It is interesting how the market sentiment and macro political and economic situation impact bank decisions and vice versa.

March CPI and Interest Rate Pause

The Bank of Canada decided to not increase the interest rate at their March meeting. Canada is the only country to pause the rate hikes after increasing them for almost a year. The rate went from 0.25% to 4.5% in a year.

Also, the February CPI number suggested that the inflation is cooling down compared to previous months at 5.2%.

However, this new GDP data puts the central bank in an awkward position. They were hoping the economy to slow down and reach borderline recession. But there is demand in key sectors and that is increasing job demand pushing unemployment higher.

Bankers must be praying for the economy to slow down at this point in time to make sure the rate hikes they did for a whole year were for nothing.

What's in it for me?

Everything depends on these data sets to be honest. "Everything" for me is my mortgage rate. A good economy and high job demand means the economy is not slowing which in turn means higher inflation. These two economic conditions can push bankers to more interest rate hikes and increase my monthly payment.

Three out of seventeen industries tracked by Statistics Canada is showing growth. I was reading a financial analysis where they noted that the Bank of Canada was expecting the bounce in the first two months of 2023 and already factored in their rate pause decision.

This is the primary analysis, and a full analysis will come in late April. That could mean that the bank of Canada will wait for that data before starting to increase rates again.

I think it is likely that we will not see a rate hike in April irrespective of this GDP boost. But they will not have other options if the market continues to stay red hot like this in the coming months.

Let's see how this plays out in the next few months. The analysts predicting rate cuts by the end of 2023 may need to revisit their predictions for now.

Posted Using LeoFinance Beta

Comments