How I Made $50,000 In Crypto Last Year

36 comments

I had a crypto portfolio worth $3,500 at the end of last year, but I thought my portfolio was worth $2,000 because I didn't know my Hive coins existed. I produced a lot of content on Steemit in 2018 and 2019 and earned a significant amount of Steem. However, when the Steem price dropped to $0.13, I stopped producing content in the crypto world and started using all my time to write sci-fi stories and novels.

In February, when the price of Steem went over 30 cents, I started producing content on Steemit again. By the way, I became aware of my Hive coins.

4,000 of my Hive coins were liquid. Since I didn't know the Hive blockchain and the Hive community, I sold them for 30 cents per coin. I also started to sell the locked ones as they were revealed by power down. Meanwhile, I was producing content on both Steemit and Hive. Content standards were higher in Hive. On the other hand, the curation mechanism worked better.

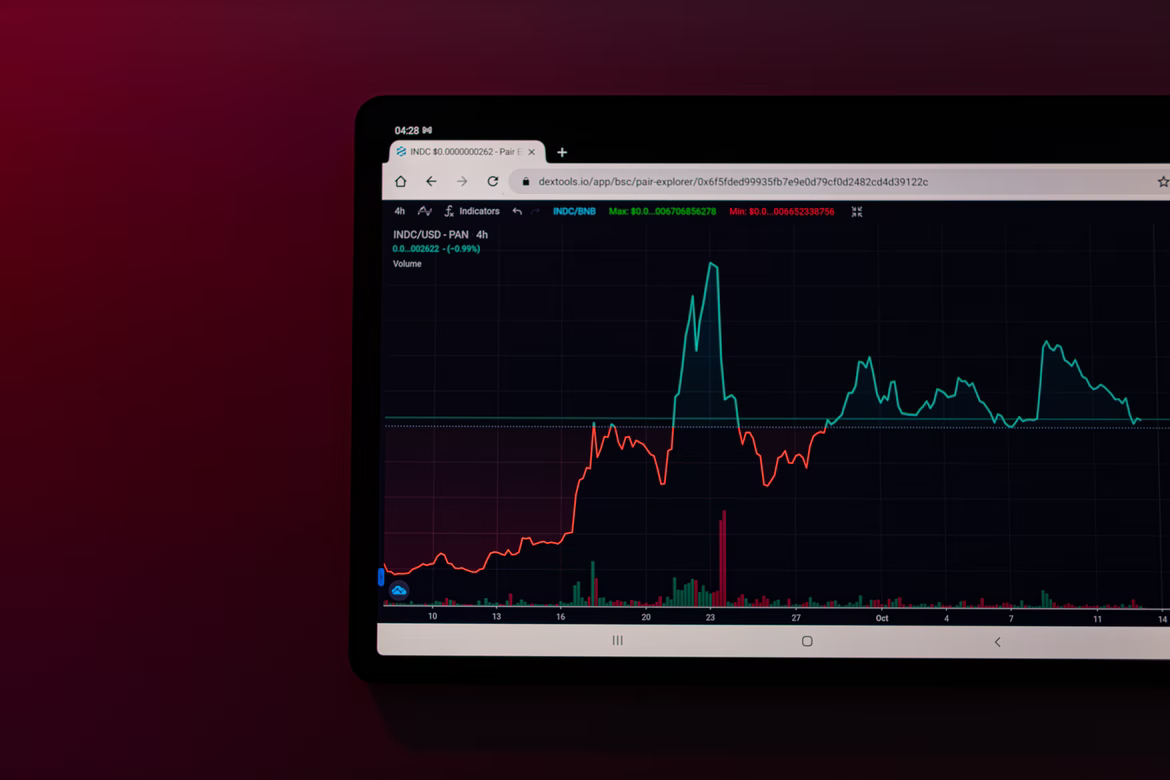

In 2018-2019, I had the trouble of only having Steem in my portfolio. This time I was determined to diversify my portfolio. I sold a significant part of the Steem coins, taking advantage of the opportunity of the price rise above 1 dollar, and started making DEFI investments on BSC. During the price recession in May, half of my DEFI investments were in stable coins. So I was less affected by the price drop.

In July, prices decreased significantly. Meanwhile, I got to know Hive better and started to believe in its potential. So I bought 10,000 Hive for 30 cents. I even bought some Steem for 25 cents, because at that time peanut.nutbox DEFI was giving Steem a 100 percent return.

As of July 21, prices in the crypto market began to rise. The value of my portfolio, which consists mainly of Hive, Steem, Ethereum, and BNB has increased significantly.

I saw these new price spikes as an opportunity to sell my Steems and used the funds I provided to develop my portfolio of Bitcoin, Ethereum, and Hive. Over time, I firmly believed in the potential of Hive and started to produce content exclusive to Hive. I also purchased 1,000 additional Hive and used this amount to develop my Hive power by leasing.

By October, crypto prices had risen, and almost all of my trades, large and small, were successful. My portfolio, which was 3,500 USD at the beginning of the year, had increased to 35,000 USD. It worked well that I spent all my time producing content and improving myself on crypto. By the way, I can say that my yearly income from producing content is around $5,000. The growth in my portfolio was mainly driven by the price rise of cryptos and successful trades.

They say curiosity kills the cat. During the year, I used over 20 DEFI applications on 6 different blockchains and made dozens of experiments on crypto trading. By the way, I didn't care enough about the security aspect. A total of $13,000 in crypto money was stolen from my portfolio on the DEFI side in 2 separate incidents. On both occasions, I looked for cigarettes in the house. Good thing I couldn't find any, or I could be smoking right now.

Due to the theft cases, my portfolio decreased to around $20,000 at the beginning of November. It meant that all my efforts during this year had been in vain. My Steems and Hives would have been worth that much if I didn't do anything.

The demoralization I experienced due to the thefts was short-lived. The number of mistakes that could be made in the crypto world was limited. I had already done most of it. The worst thing that could have happened to me was getting discouraged.

A few days later, Hive Punks was announced. I bought 2000 Hive on Binance and used this fund to buy 100 Hive Punks. One of the Punks I bought was quite rare. By selling it for 10,000 Hive, I have more than compensated for my loss due to the theft.

On November 23, the Hive price started to rise again and stabilized between $1.50 and $2. Even though I sent the cost of the extra purchases I made during the year to my bank account, my crypto portfolio is still worth $54,000 and two-thirds of it consists of Hive ecosystem assets.

There were times when things went well or badly during my crypto adventure. As the law of large numbers indicates, a balance occurs over time between lucky and unlucky events. In the long run, it is the effort that determines the result. I am happy that my hard work paid off in 2021.

I hope 2022 will be a good year for all of us.

Thank you for reading.

Image Source: https://unsplash.com/photos/lGB8j50arHk

Comments