Robinhood Options Trading Day 12: Strategies Overview & Trade Updates

0 comments

Good morning everyone. After being away for about a week handling some family and work business, I would like to take this opportunity to apologize for the delay on strategies, and updates.

Today I will incorporate some chart patterns, diagrams, and screenshots of data from the options I purchased, and the charts will have some indicators I use.

Currently I use some scripts and indicators developed by my business partner Cryptomyday a.k.a. Trade Buddy; and we test them together. I will add these proprietary indicators to the chart later and discuss in detail. For now we will go over the basics.

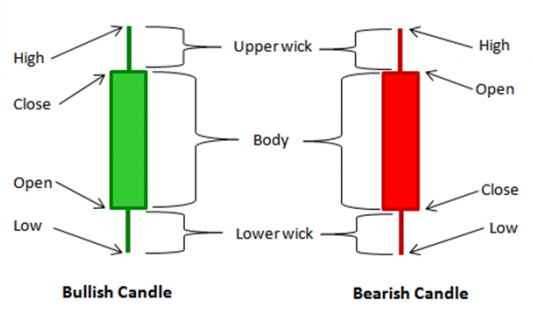

NOTE***We are looking at MSFT, Microsoft, on the 1HR Time Frame and will now go over candles, wicks, low, high, open, close.

A. The TOP of the Red candle body is the open price of the stock when the candle started, also the high if there was no candle wick above it.

B. The BOTTOM of the Red candle body is the close price of the stock when the candle closed that hour, also the low if there was no candle wick below it.

C. The BOTTOM of the Green candle body is the open price of the stock when the candle opened on the 1 hour time frame, also the low if there was no candle wick below it.

D. The TOP of the Green candle bbody is the close price of the stock when the candle closed on the 1 hour time frame, also the high if there was not a candle wick above it.

E. A lower wick on a candle is the 'low' or lowest price the stock reached during that 1 hour candle.

F. A higher wick on a candle is the 'high' or highest price the stock reached during that 1 hour candle.

G. The current price of the stock. This will be the upper end of the bar (not the wick) on a Green candle, and the lower end of the bar (not the wick) on the Red candle.

Primarily we look at the indicators one by one, referenced by the numbers on the above chart in bright green:

ONE. Regular candles on the 1 Hour/ 4 Hour/ 1 Day Timeframes, indicates the price of the stock, and the movement of the price during that particular time frame.

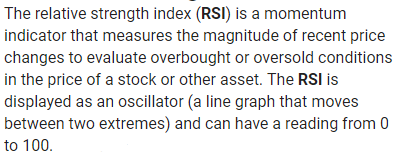

TWO. The 2nd indicator is a combination of RSI and SRSI across multiple time frames. Google defines them as:

What we are seeing is a green, yellow, and red LINES (NOT the shaded colors): GREEN: Current Time Frame RSI YELLOW: Current Time Frame SRSI RED: Anchor or larger Time Frame SRSI (guides overall direction of lower time frame) These each move independent of each other but at low or high points in the price, will often move together.

In the chart below I am showing that all 3 RSI/SRSI indicators are overbought, and should head down soon and cross the red line, bringing price or consolidation with it most of the time.

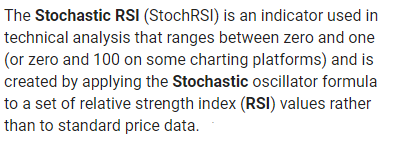

THREE. Average Directional Index -ADX (Black) and Positive & Negative Directional Indicators - DI+ (Green) & DI- (Red)

However, the DI+ (Green line) is low, and possibly heading in an upward direction, while the DI- (Red Line) is heading down. I want to stick to these 2 for now and can discuss ADX later.

If the Red Line is moving up, and the Green Line is moving down; generally the price is consolidating after an increase, the price is about to be going down, or the price is already going down.

If the Red LIne is moving down, and the Green Line is moving up' generally the price is about to consolidate after a decrease, the price is about to be going up, or the price is already going up.

This simple indicator helps me determine momentum and movement, along with the RSI/SRSI and other factors.

However, we will discuss ADX and the DI indicators much more in detail later. For this illustration, I am just giving examples of what I use to determine the math probability that the stock will move in a particular direction.

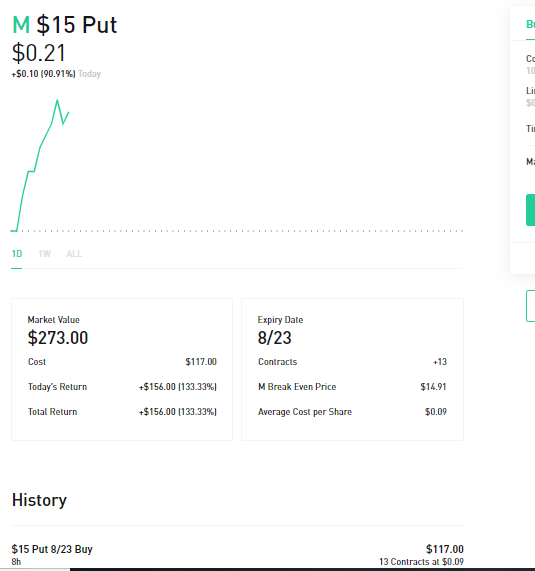

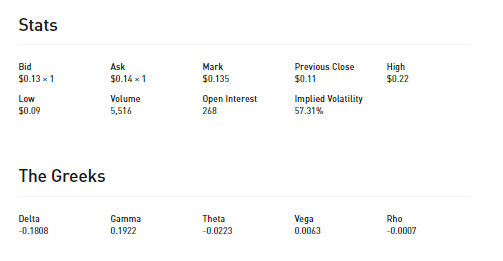

Yesterday the news on Macy's was quite bad, despite the corporations attempts to downplay their earnings and retail woes. I placed a put at $15 with 8/23 Expiration. I anticipate the stock to drop more, but level out at some point, with blood buyers stepping in. However, Macy's and retail in general are on the decline. Amazon and other online retailers are making it harder and harder.

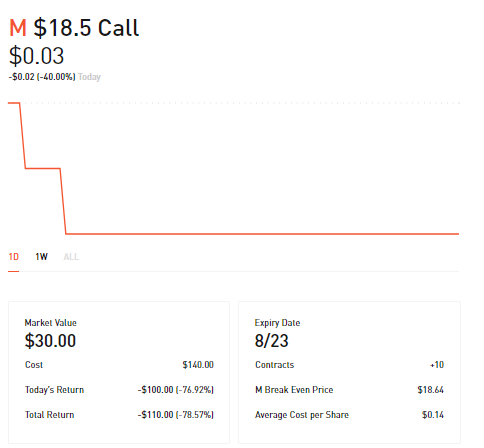

I originally bought a Macy's CALL assuming it would have lots of buying pressure on the dip. This was not the case as you can see below, so that's why i bought the PUT above.

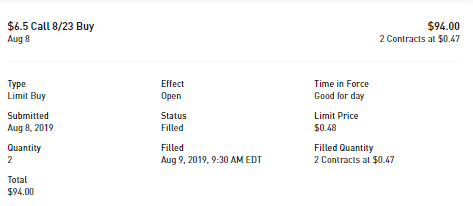

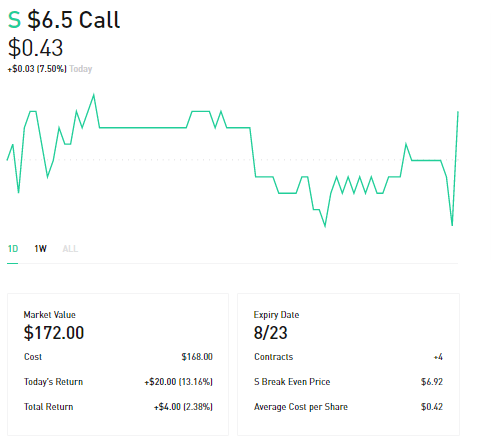

S- Sprint was purchased on August 8th and filled on the 9th, for $168. Currently it has come back into profit. I also have a PUT option on this same stock to hedge any potential loss.

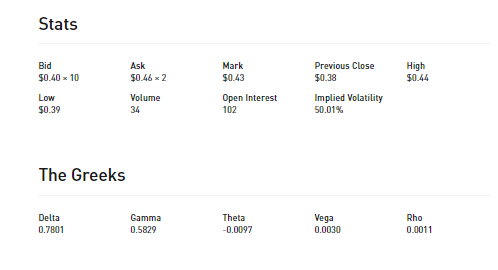

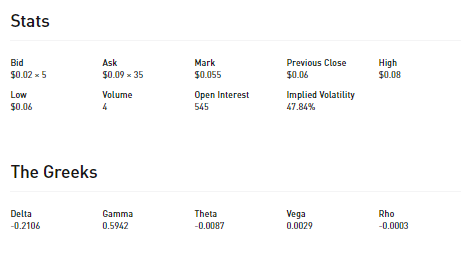

Here is the Sprint PUT option that I missed jumping to $1.05 credit. I would have made $900 if I could have sold it. This is why you want to set profit targets after you buy. $0.50 cents would have been a good target, and most likely filled, giving us a $400 profit on a $99 trade. Right now it's lost about half it's value with a week to go til expiration.

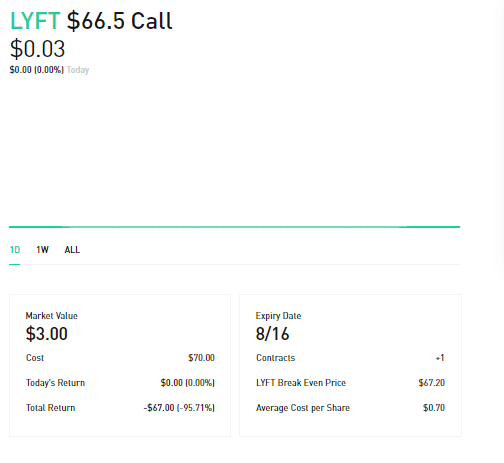

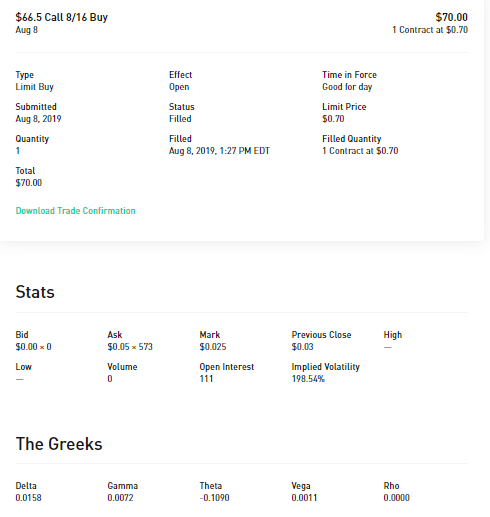

LYFT - Lyft was purchased a few days ago, and the CALL is not looking good because the overall market is down. I have not placed a PUT against this trade yet to hedge losses, because I am still watching to see which direction the market will go. This wasn't a good trade.

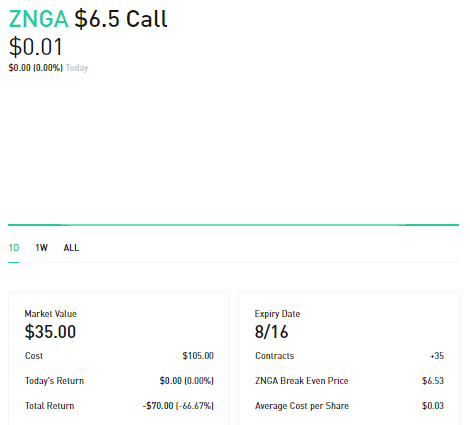

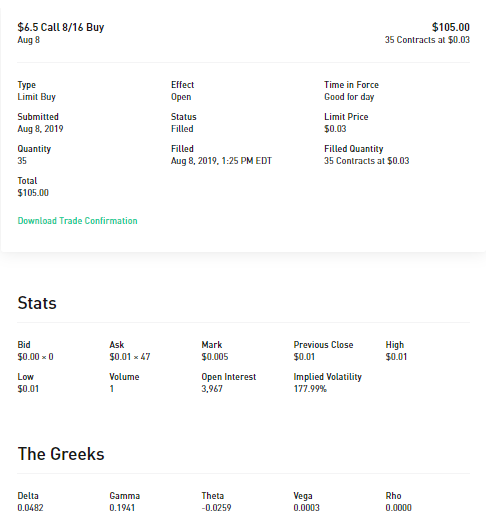

ZNGA - Zynga Inc. The Call details are below, also lost value due to direction of market. No PUT purchased. The price has dropped a lot the last few days. When it bottoms out, I will likely buy a CALL to catch some of the loss back.

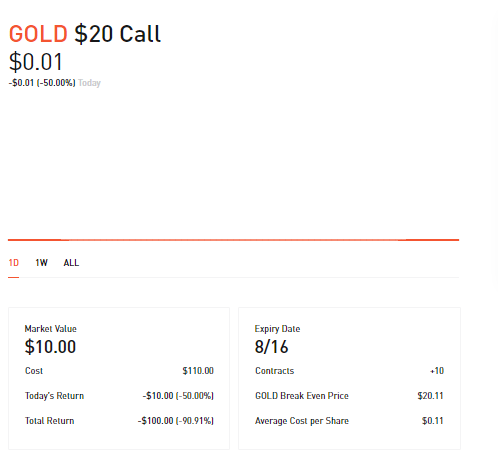

GOLD - Barrick Gold Corporation - CALL. The price has gone up for GOLD, but the open interest in the options for this stock have not. It's price has mostly moved sideways the last few days.

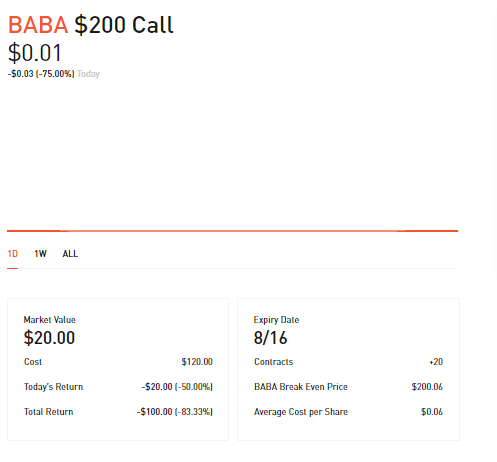

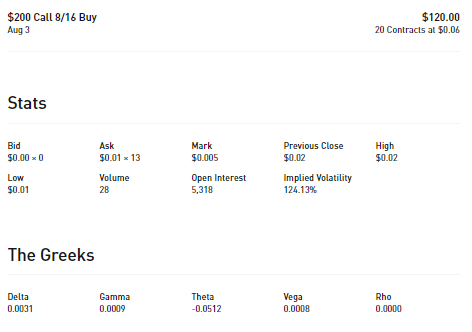

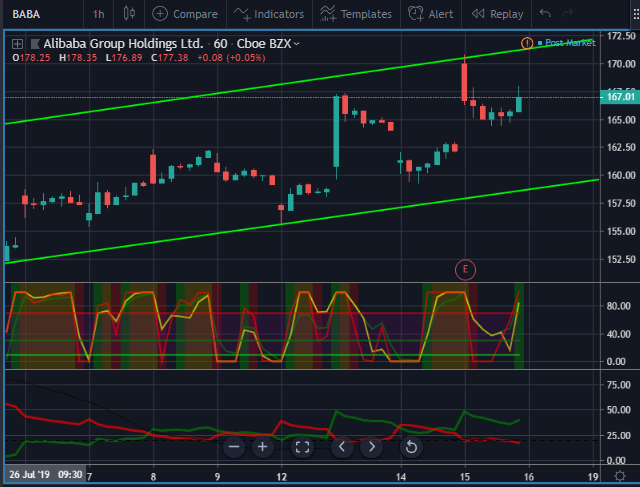

Alibaba- BABA - I purchased this CALL and it has moved mostly sideways, and there has not been a lot of interest in this stock option that I purchased. I will wait for the bottom, and buy another CALL to recover some of this loss. (Dollar Cost Average- in this case, buy a stock at intervals as it drops, or at the bottom; and earn a return when the price rises again.)

The stock is in an upward trend channel, and doing quite well, despite the trade war news. However, not a lot of Bids at this price, however; lots of open interest. I would likely need to 'renew' or re-buy this option at double the cost to recover this loss if it were to continue the trend up. Otherwise, determine a different strategy.

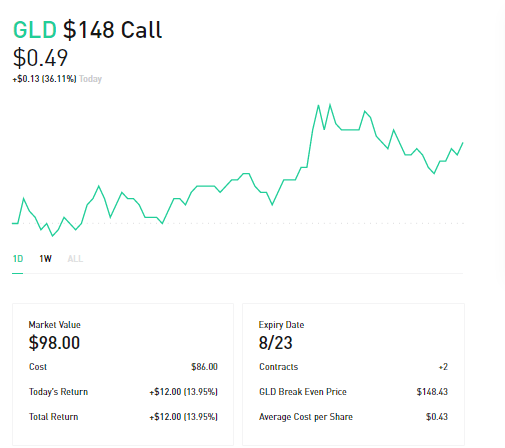

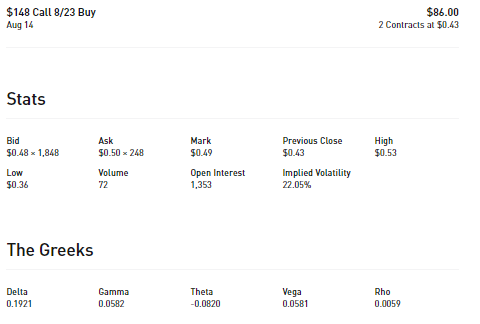

GLD - SPDR Gold Trust Shares - I purchased this call anticipating a major move up in price, because of the trade war with China. However, i also found out shortly after, that China has halted all US GOLD Bullion imports, thus reducing the USD currency flow back to the US on gold shipments, and it appears other bullion shipments since it is bought and sold in USD currency. That has led to the option moving sideways mostly, but it's still trending up. I will hold this one to expiration.

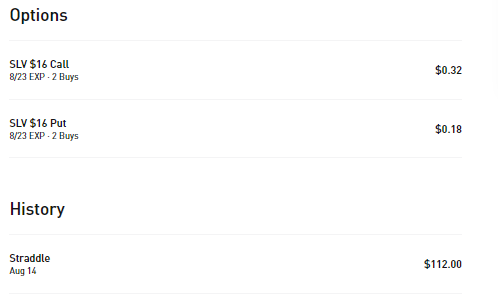

SLV - Ishares Silver Trust Ishares - We placed a Long Straddle order on this Stock tied to Silver, because we want to test out a strategy that will have either a big move up or a big move down.

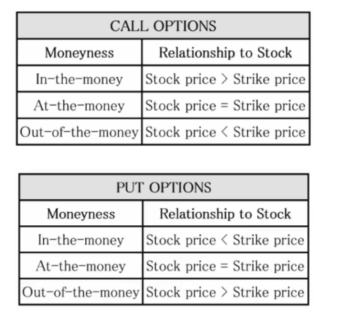

So, a Long Straddle is a simultaneous purchase of a Call at an In the Money strike price (a price below the stock market price) and a purchase of a Put at a higher price Out of the Money ( a price above the stock market price). (ITM, ATM, and OTM are defined in detail below this trade, with the image diagram)

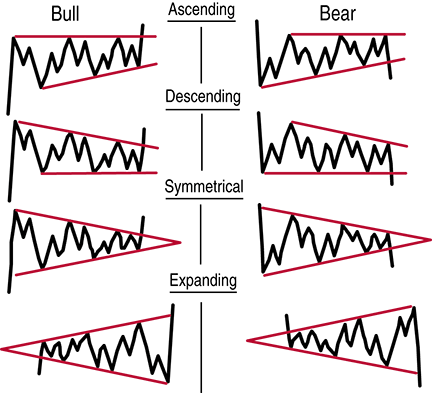

Our hope is that the stock option will move up more than .32 cents or down more than .32 cents for us to make a profit on this stock. What we don't really want is a continuation pattern. (more on that below this trade)

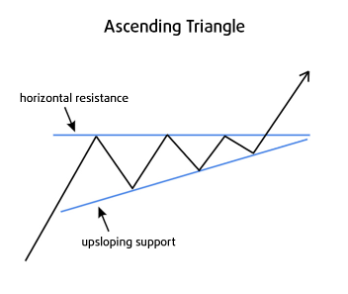

In this chart you can see the stock is in an uptrend. We look at this and see an ascending triangle to a potential breakout UP. Even though there is a gap in the price movement, the shape is still there. SLV should continue up.

In the Money vs. At the Money vs. Out of the Money

Bullish & Bearish Continuation Patterns

![]

![]

STILL EDITING THIS POST, PLEASE STANDBY...

Comments