ANOTHER MAJOR BITCOIN CRASH COMING SOON?

81 comments

OH NO!! Bitcoin is over! This is horrible news guys! We need to sell everything right now because bitcoin is going to ZERO fast! How do I know this? Unfortunately, the financial gods over at Morgan Stanley have done the research to prove it! They've got the data. Case closed! Right?

Wrong! Bitcoin is not a popping bubble. In fact, Just the opposite is true! Keep calm and HODL on!

Isn’t it interesting how just a few months ago when Bitcoin was at 15-20k the main stream media was singing Bitcoin’s praises? Even my grandparents wanted to get into bitcoin because of all the hype. I couldn't turn on the TV without hearing some "financial expert" talk about how bitcoin is going straight to the moon. THe result was that many new investors bought high back in November and December. But how the time have changed! It seems that just a few months later, the same exact media outlets are talking about how dangerous Bitcoin is and how everybody should be careful. This fear uncertainty and doubt has caused thousands of new investors who just bought in at 15k to sell at 8k! The media is spreading FUD and is causing everybody to buy high and sell low!

Hmmmmm….is it possible that they are using their platform to manipulate the masses thereby manipulating the bitcoin price in order to make a profit?

In the midst of all the FUD surrounding possible crypto regulations, Google and Facebook banning ads and ICO pump and dump scams, Morgan Stanley released some startling news about bitcoin. You can check out the article here

The story goes on to say that Morgan Stanley analyst Sheena Shah conducted some "Bitcoin research". And what do you know! The data shows that bitcoin is behaving a lot like the Nasdaq did nearly 20 years ago, during the time that the dot-com bubble burst. But here's the plot twist...According to Morgan Stanley, the timeline is unfolding 15 times faster than the NASDAQ bubble pop. Here is an excerpt from the article:

"Per a note the financial institution sent to its clients, both the Nasdaq in 2000 and bitcoin nowadays rallied between 250 and 280 percent in their most bullish periods. Sheena Shah, a strategist at Morgan Stanley, noted that bitcoin’s rally was 15 times faster than that of Nasdaq in 2000.

Per Shah, both the price moves and volume behavior are similar when compared. The analyst noted that bitcoin lost 45 to 50 percent of its value in a recent bearish wave, just like Nasdaq did 18 years ago.

Shah further noted that the Nasdaq bear market of 2000 had five similar prices declines “averaging a surprisingly similar amount of 44 percent.” Bitcoin recently fell from a $19,200 all-time high in mid-December to $8,530 at press time.

Trading volume, according to Morgan Stanley, is another red flag. The analyst noted that bitcoin’s trade volumes surged 300 percent since December, but keep falling each rally ahead of the bear markets."

Can Bitcoin Be Compared to the NASDAQ Bubble in the Early 2000's?

Bitcoin and cryptocurrency in general cannot be compared to the NASDAQ bubble in any way. In fact, it’s doubtful that we can even use the term bubble to describe the cryptocurrency markets!

In order to decide whether there really is a bubble or not, we must first establish what a bubble is.

Investopedia defines an economic bubble as this:

"A bubble is an economic cycle characterized by a rapid escalation of asset prices followed by a contraction. It is created by a surge in asset prices that is unwarranted by the fundamentals of the asset and is driven by exuberant market behavior. When no more investors are willing to buy at the elevated price, a massive selloff occurs, causing the bubble to deflate."

Does Bitcoin Fit the Definition of a Bubble?

Absolutely not! One of the main reasons is that in a real bubble hardly anyone actually thinks it's a bubble.

In fact, it is usually quite the opposite.

That is the reason it bursts in the first place.

At the peak of price cycles you have everyone on the same side. All the bears have been converted to bulls and have bought in hoping for the ride to keep going.

When there is no one left to buy, that is when the music stops and the bubble bursts. Leaving many hurt investors along the way. This is exactly what happened during the NASDAQ bubble back in 2000. Nobody in the mainstream was calling it a bubble.

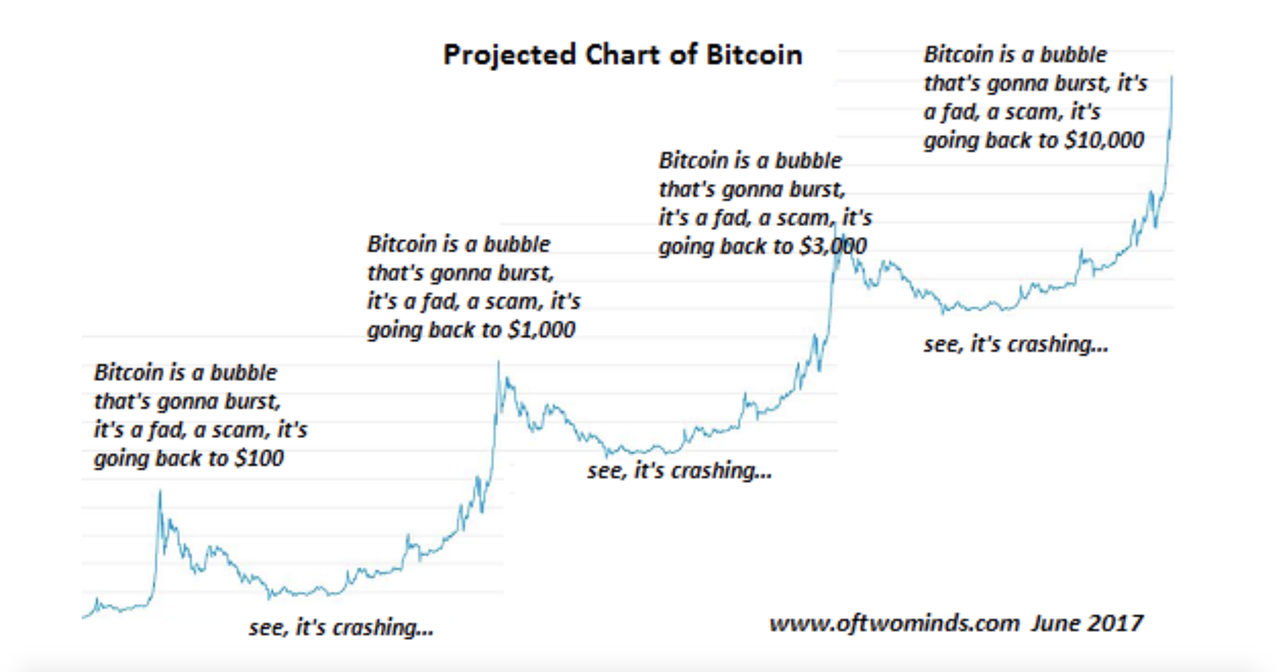

Compare that to Bitcoin. From its very inception people have been crying BUBBLE. Especially the mainstream media. It was a bubble at $100. It was a bubble at $1000. It was a bubble at $2000, at $3000, at $5000 etc etc! We go through the same thing time and time again. Bitcoin experiences a run up, all the bears cry bubble and then Bitcoin experiences a major correction. All the nay-sayers cry "I told you so" and then Bitcoin inevitably experiences another run up to reach a new all time high! If Bitcoin was in a bubble, then it has already burst and re inflated at least 10 times. Since bubbles do not have the ability to re inflate themselves, it is safe to say that Bitcoin is not a bubble. But there are MANY other reasons as to why Bitcoin cannot be compared to the dot com bubble.

Bitcoin Is Not a Product or a Service. It Has Intrinsic Value

Unlike most other assets whose value driven up exuberantly based on the demand of the market, Bitcoin and other cryptocurrencies actually have value in and of themselves. This is because Bitcoin is a medium of exchange. It is a currency (like a dollar). However unlike a dollar, it has value in and of itself. Bitcoin is valuable because it is a decentralized peer to peer network that provides individuals with monetary sovereignty. It cannot be counterfeited and it cannot be manipulated or defaced by a central power.

This is because, unlike the dollar, the supply is fixed. There will only ever be 21 million bitcoins in circulation. period. No matter what happens in the future, there will only ever be 21 million Bitcoins. There is no trickery going on with central banks adjusting the supply. This is why so many people look at Bitcoin as digital gold. Gold has value in and of itself because of what it is - a beautiful metal that is difficult to mine and refine. In the same way, Bitcoin provides individuals with security, financial sovereignty and privacy. These are things that every human being wants and are not affected by changing markets or selloffs.

Bitcoin is a currency with intrinsic value. Start up web companies in the 2000's were only as good as the demand for their products or services. You cannot compare Bitcoin the crypto currency to startup internet companies in the early 2000’s. You it’s like comparing apples and school busses.

And that leads me to another important point...

Bitcoin is not a company.

I always try to explain this fact to my grandfather. There is no bitcoin CEO that is in charge of bitcoin. Bitcoin does not earn a yearly profit nor does it do its taxes each year.

Bitcoin is unlike anything we have ever seen before. It is a digital currency, backed by blockchain technology that has attracted the interests of millions of investors and people throughout the world. It is simply an algorithm that is used as a means of transaction. Its value is based on supply and demand laws, so the more people want to use the digital currency, the more its price will grow. The more individuals who decide "Hey, I'd much rather use this peer to peer decentralized private medium of exchange called Bitcoin than dollars" the more valuable Bitcoin will become. And again, because the supply is fixed, then much like gold and silver, there will never be more supply to meet increasing demand. Not to mention each cryptocurrency has a network behind it. There are literally millions of users for Bitcoin and many altcoins that interact and communicate every single day. It is much more than a company or companies with a products.

The economic principles that applied to other bubbles in the past are not applicable to the coin.

I simply don’t think we can really compare the whole crypto-market to the dot com thing in 2000.

That being said, do I think that there be price spikes and dips along the crypto journey? Absolutely! 100%.

Are we in the crypto doldrums right now? Absolutely.

However, with Bitcoin there is much hope!

Let's put this all into perspective. Bitcoin is up over $4,000 since October. Bitcoin is worth more (measured in US dollars) than ever before. If we stop looking at the short term FUD and keep our eyes fixed on the big picture, it's obvious that we are ahead of the game. Yes, it sucks for those who bought in at 15k or higher. However, for those of us who have been in this space since 2016 or before, we are in a FANTASTIC position. And even for those who got in a a bad time, there is still MUCH hope! Just hang tight. We will see new all time highs.

Take a Look at This Illustration

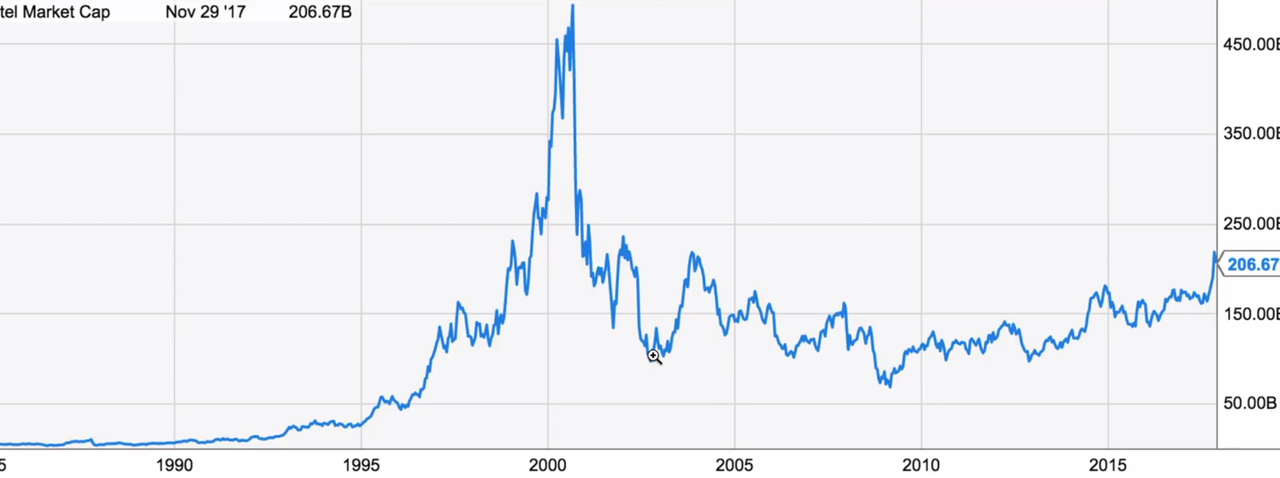

This shows the history of Bitcoin. All along the way there were highs and crashes. All along the way people were screaming bubble! If you don't believe me, go look at the bitcoin charts. If you still don't believe me, do a google search for bitcoin bubble and search for news articles from 2011, 2013, 2015 etc. You will see that from the get-go the media was screaming bubble and at every crash there was a big "I told you so". Notice how resilient Bitcoin is even after the so called "bubbles" pop! Now compare that to the NASDAQ chart from 2001. Very different. After the bubble popped, there was no recovery.

So in closing I just want to say that you should not believe this bitcoin bubble nonsense! This technology is here to stay and just wait - it is going to 50K before we know it! What do you think?

▶️ DTube

▶️ IPFS

Comments