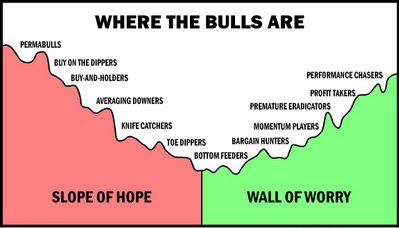

Wall of Worry

28 comments

Blast from the past

I forget what the above picture is from... Kinda looks like Magic the Gathering. Reverse image search on Google points to death metal. In any case I have no idea how many years ago it was, but I spent a couple hours doctoring this image so it could be tiled like it is without being able to see the edges. Can you see the edge? I can still see it pretty easily because I'm the one that modified it, but it is subtle.

The "wall of worry" is a Wall Street term that describes the tendency of stock prices to rise despite negative news, economic uncertainty, or political or social conditions that would suggest they should fall. The term was coined in the 1950s.

You'll know it's the top when everyone thinks it's never coming down.

2025 has just begun and already everyone is hypersensitive to any move in either direction. This is especially true with the unit bias in play at $100k, where every price point greater than $100k is intrinsically considered bullish and vice versa: every price under $100k feels like a gut punch. Meanwhile, none of these moves actually matter. We just have to wait for the real run to begin.

Wen?

Bitcoin hasn't really made a real move since November, but in that time alts got some pretty good action. Most recently our very own Hive catching a bid. Now we have some room to breathe, as it were. Will we leave behind rank #500 in the dust, or are we doomed to revisit such a low level? I must admit I am a little pessimistic considering the history of such things, but then again pessimism in a bull market that only comes once every four years is definitely not where anyone wants to be.

"Prices rise despite negative news"

This is a conclusion I came to years ago on my own when I realized that the news has pretty much zero affect on the macro market. The market is going to do what the market is going to do. The news is irrelevant but also acts as a catalyst. So the market can make a big move on this or that news; making it look like the news was the reason for the event. In reality the event was always going to happen with or without the news to justify it. We can't reverse engineer these things with any kind of certainty.

Solidly back into six figures

It really is annoying how powerful unit bias can be. Our desire for strong round numbers defies logic and reason. Bitcoin is "too expensive" because owning one costs a lot, even though we don't have to own a full one. Five figures is bearish while six figures is bullish. It's all nonsensical tricks that the mind plays on us.

It has been very nice though that even after this 10% bleed across the board that Hive itself still towers at a +60% gain on the week. Everyone else is losing their minds but for once our community is somewhat spared from the Wall of Worry that consumes these small moves that mean absolutely nothing. Of course this someone leads me to believe that Hive may continue to bleed as it often does... but that's not today-me's problem, so I won't worry about it just yet.

Time for a rotation?

With Hive being up as much as it is I wonder if I should rotate some into bags that have been floundering as of late. Currently looking at Rune (Thorchain) and Cacao (Maya) as possible candidates because they are getting absolutely crushed on the cap rankings and I believe these DEX networks have a lot of potential value. Of course maybe this is the disadvantage of having a non-hostile political party getting elected. If Trump rolls back all the crypto regulations that makes it more difficult for the decentralized counterparts to gain a foothold.

Also I don't really have any Hive to sell and firmly find myself in "not powering down" mode. The liquidity that I do have is somewhat reserved for buying back into Hive if and when it crashes into the 40-45 cent range. I've been quite blessed with my financial status in that I haven't been forced to sell crypto for months to pay my bills. That's all taken care of and will continue to be for a while, so that's nice.

Unfortunately I've been in full-on burnout mode and have taken the last month off from blogging, and every time this happens it's like waking up from a hangover of regret when I realize all the rewards and opportunities that I've missed out on... especially now that the token price is so much higher. Oh well these things happen. Time to get back on the horse.

Conclusion

There will always be a reason to worry in a market this volatile.

You can't see the forest from the trees.

Zoom out and don't pout.

Comments