Hive Tipping Point Approaches

38 comments

It never gets easier!

The four year cycle has not been as kind as we would have liked. It's been an honor clawing through the trenches with the other degens on this network, but the days of just trying to survive the crypto winter are coming to a close. All hail the majesty of 2025.

The numbers and variables are different for everyone, but I start to notice these things real quick when I begin to plug the numbers and do the maths. My 100% upvote as of today is $6. Meaning I can create $60 worth of inflation a day... quite a bit for just clicking a button 10 times, eh? Half of that is the curation kickback that goes directly into my Hive power. That's a $900 a month yield per month. Double that to around $1800 a month if I'm writing blog posts.

Seeing as I live under the poverty line in America (by choice at this point) this is more than enough to pay all my bills and still have some money leftover for whatever. It's always a big milestone when this happens and I realize "wow this is like a real job". Proven by the fact that I haven't earned a paycheck anywhere else since before September 2021 when I moved to PA.

And then comes the pipe-dream thinking and counting of chickens before they hatch. What happens if Hive were to go x10 from here? Then I'd be making like six figures yearly and have a massive 7 figure powered up stack. Would it be could it be let it be. Please please please.

Although I'm not so naïve this time around as I was in 2021. I may have been here since late 2017 but I've only actually experienced one true bull market from start to finish. If I'm being honest it was a bit lackluster and I expected more. I think we all did. Maybe 2025 makes up for it. Maybe not.

Most of us have experienced huge disappointments when it comes to crypto. There is never any shortage in this regard. In fact when emotional state rises to this level of "wow I finally made it" or "wow I finally made it all back" the market usually pops in to remind you just how fragile these liquidity pools really are.

Creating liquidity with USDT

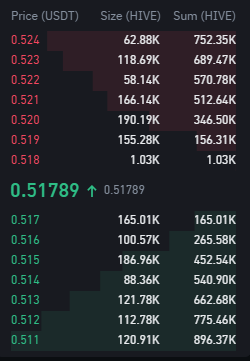

Hive craves liquidity and the recent perpetuals listings have been providing a lot "out of thin air". Derivatives require collateral to exist, and the vast majority of perps collateral is USDT. We can buy and sell Hive on these markets using only USDT, which is extremely useful to our network in particular because so many of our governance tokens are locked inside the governance contracts.

For example today is not a particularly crazy day but just the 24 hour liquidity on Binance perps for Hive is showing $429M worth of daily volume. That's almost double our entire market cap. The bots and liquidity providers and legitimate users are sloshing quite a bit of money around within the casino, and that's good for us.

wow... nice

If we tried to buy a million Hive on the perps market it would barely move the price... not even one penny higher. And the only thing required to buy that amount would be some amount of USDT leverage. Could be x1 or could be x100, whatever the trader decides is reasonable.

Compare that to the spot market and price would spike 20% or more. Of course these perps contracts are not "real" and only offer the user price exposure to the underlying asset, but still that has a lot of value in itself. It also seems like the massive liquidity of the perps forces the spot liquidity to be higher than it was just a few months ago as well. That's good for everybody.

Hive continues to grind forward

We've got a lot of interesting projects rolling out this year. A lot of it is just "boring infrastructure" but infra is a required toolkit for creating all the cool stuff. I keep telling myself I start grinding out my own project soon™ but we'll see how that goes.

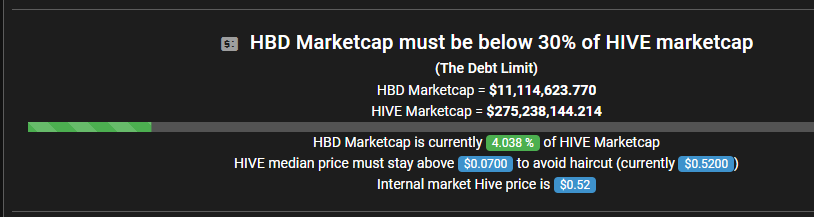

Another huge milestone that is going largely unnoticed is that our debt ratio has already gone full circle in very short order. Things were looking a little dicey there when it was 10%+ but now we are back under 5% even after providing 15%-20% yield on HBD for an entire 4-year cycle. Take a minute to realize how big of a deal that is, especially in the face of all the naysayers who said this was impossible to sustain. The math was on our side the entire time and it was obvious (to me at least). High yield on HBD will continue to benefit the network by providing more value than the cost to run it... that is until the math is no longer on our side, in which case I'd make a plea to lower it.

Some will look at numbers like this and think maybe it's time to boost the yield back up to 20% or even higher. And that is exactly what we don't want to do. Yield is a lagging indicator by definition. APR itself is YEARLY, as in the number doesn't materialize until a year from now. As number goes up we should be considering lowering the yield even further during the good times so that we have runway to jack it up during the bear when everyone needs a win. Buy low sell high. But I digress...

Moving forward

Hive obviously has a lot more work to achieve. We desperately need more ways for our users to build value and get paid for their work (IE content creation or any other job we can muster). Easier said than done obviously but I think we'll get there sooner or later.

Conclusion

Number going up is a weight lifted from everyone's shoulders.

Don't squander the opportunity.

Comments