An Op-Ed on "Chapter Three: The Returns of Giving" In Wealth and Poverty by G.F. Gilder.

1 comment

Module 8 Essay: An Op-Ed on "Chapter Three: The Returns of Giving" In Wealth and Poverty by G.F. Gilder.

Alexis Del Angel

School of Business, Oklahoma State University – Stillwater

EEE 2083: Entrepreneurship & Society

Professor Steve Trost

3.12.2023

Module 4 Essay: An Op-Ed on "Chapter Three: The Returns of Giving" In Wealth and Poverty.

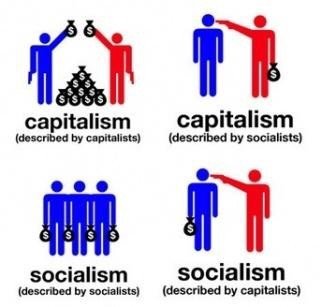

The following will be an essay on Chapter Three: The Return of Giving in Wealth and Poverty by G. F. Gilder. He goes at great lengths about the economic value of capitalism, its proponents, and how it compares to other types of economic markets. Many different perspectives are utilized by Gilder to attack the capitalist market, whether that is the liberal, conservative, idealistic, progressive, etcetera perspective. Gilder never gives up on seeing it from a different angle. He goes on to establish how fundamentally the entrepreneur seems to make their capital by giving society something it wants or may need. It is this cyclical nature of supply before demand and banking on faith that helped establish the proliferation of a capitalist system amongst societies.

On: "Chapter Three: The Returns of Giving" In Wealth and Poverty.

Gilder opens up his chapter by establishing his fundamental point;

"Capitalism begins with giving (Gilder, 2012, p. 27)."

Here Gilder is getting at the fact that in order for there to be successful entrepreneurs, one must be willing to part with risk or an investment of capital in order to ever think about a returning profit. This is fundamental because, in many ways, just like Francisco's speech, this gets to the core of human values, not just with respect to trade but people as well. Capitalism is almost predicated on this initial supply, it takes people doing stuff for other people. He goes on to establish the fundamental way of economizing for the primitive societies before us, one of supplying to a very specific demand and creating an exchange by placing the onus on the person engaging in this investment with their society. In other words, the issue with this approach is that it is inherently tied to its time and to its scale; with respect to raw capitalism, it tends to look like the total opposite.

"The gift comes first (Gilder, 2012, p. 31)"

In giving first, the receiver now has to understand the giver in order to repay them. This spread out the debt, but it also made it harder to define and thus slowed the formation of money. Money is helpful because it psychologically ties a person's expenditure to the value of a later purchase. This brings the ability to invest, which, according to Gilder, is the true gift of being in an advanced capitalist monetary economy.

"Capitalists relinquish resources to others in the hope of surprising transformations, new goods and services, and new value to be reinvested. One does not normally make gifts without some sense, possibly unconscious, that one will be rewarded, whether in this world or the next (Gilder, 2012, p. 35)".

The quote touches on the points I was establishing beforehand and leads to the next. That is, it is very possible to confuse a capitalist's intuition or drive for greed. Gilder posits that while yes, their goals may seem a bit more mercenary, that is only because money is the root of their production, but one must ask themselves; what would a capitalist need in order to invest, engage, or passingly interact with in a capitalist society? Capital. It is important to note that Gilder does not completely absolve capitalists of self-interest.

This places importance on vision and conventional wisdom. The idea is that the more we wait on raw data, paradoxically, the slower we are to react, and seeking financial hoarding does not really lead to more money, "rather it leads to a quest for power over others (Gilder, 2012, p. 40)". The idea being that businessmen themselves will now become the barrier to those who hoard knowledge, are too dangerous, corrupt, and/or are simply seeking power over others; in other words, the capitalist is doing us a service.

A service that is predicated on of faith. Which I found most interesting of all of Gilder's points. He states;

"The ultimate strength and crucial weakness of both capitalism and democracy are the reliance on individual creativity and courage, leadership and morality, intuition and faith. But there is no alternative except mediocrity and stagnation. Rationalistic calculation, for all its appeal, can never suffice in a world where events are shaped by millions of men, acting unknowably, in fathomless interplay and complexity, in the darkness of time (Gilder, 2012, p. 48)."

Ultimately, it is up to the faith of a capitalist whether they decide to invest and spend that capital. I really enjoyed this point because it really showed Gilder was not just a capitalist shill. He was willing to recognize criticism from other ways of thinking or from fundamental thinking. And in doing so, I think he ends very poetically. You know that in order for a capitalist society to truly shape the future, it "must ever live in doubt and thus thrive on faith (Gilder, 2012, p. 49)". This is important because it is not just a vapid criticism of capitalism. It is pointing at the very big hole that is this whole system being held together by duct tape and sticks, and at any moment our "security" could come crashing down. It was very honest and refreshing of Gilder to say that capitalism is effectively a leap of faith covered in doubt.

Conclusion

In conclusion, I had a really great time reading what Gilder had to say. It was nice to read something economic that was not so in love with capitalist markets and societies. I understand that it is very easy to get jaded, but it starts to feel a little surreal how little economists are willing to substantially critique the economy. Bastiat is still king when it comes to that crown. Gilder was incredibly thorough, and it was really refreshing to hear him talk about the socialist perspective on top of the liberal perspective on top of the conservative perspective. It may be boring to hear about, but if we are to call the economy this process, this million-person moving in the dark machine, then the way certain ideologies and fundamental ways of thinking interact with it becomes just as important.

I think Gilder spending so much time addressing all these points and how they interact with capitalism and how they maybe have fallen by the wayside or why they have fallen by the wayside does a way better job of establishing and proclaiming the benefits of a capitalist economy and society. Hearing what the conservatives have to say is relevant; they are just as much a part of this machine as we are, and by keeping in tune with their criticisms, we might be better entrepreneurs for it.

I do still think his criticism of capitalism was fairly shallow. When you spend 30 pages talking about its praises when comparing it to "noble savages", dedicating two paragraphs to criticisms of capitalism can feel extremely unbalanced. I guess I am just of the thought that if security is so hard to come by and it is so hard to actually be delivered to us as citizens. Then is capitalism not doomed as well? I do not think it is fair to look at all the shortcomings of a socialist or communist society and act like capitalism is not doomed to repeat the same shriveling in power and relevance. I guess that is just all the more reason to stay in tune with what other fundamental thinkers think about a society with a capitalist economy and market.

References

Gilder, G. F. (2012). "Chapter Three: The Returns of Giving." In Wealth and Poverty (pp. 27–49). essay, Regnery Publishing, Inc.

Comments