City Real Estate Will Be Left To Rot

3 comments

As more and more things come out about the future of the banks, the Greater Depression we are going into, and the changes to the world, the more clear it is that city real estate is doomed.

Cities used to be the hub of economic activity. But, so many cities drove away the industries that made things. And now, they are slowly dying. Manufacturing is the basis of the economy. And cities built up around that. Providing parts and materials to the factories. And those people needed services, food, housing, entertainment. And so, those service industries came about. But, that is almost all that is left in the cities. Without manufacturing, the city will not survive.

And most of them aren't surviving. Blue cities drive off the conservatives who are build and repair things… conserve things. (liberals are needed to explore arts and look for new things/ new ways, but they can't exist without real world support) So, blue cities are dying, and cannot recover without turning red, and way red, to start rebuilding their city infrastructure.

Money manipulation has replaced manufacturing as the way to get rich. Shuffling money only works while we have fiat currency printing. So, a great deal of the money flowing through places like New York is illusionary. And can disappear at a moment's notice. Real estate relies on this printed money, and the printed money relies on real estate.

So, basically, the big cities, who have no, or little, manufacturing, are collapsing, and soon, it will be apparent to all.

Commercial Real Estate is Toast

Of the things that Covaids taught us, the one that is not up for questioning is "you can work from home". (of course, many old managers are arguing this, but they have lost) And, when there nobody using a great big building, you need to sell it to someone who will. But, there is nobody.

Giant commercial buildings have been sold recently for 10¢ on the dollar. I bet you will see some sold for $1, just so they can offload the maintenance costs.

The real losers of this game will be the banks. The mid-sized banks that believed that commercial real estate was a sure bet. There is no one to buy these. There is no one to use these. And so, the banks will be left holding the bag.

The banks will try, with all their might, to re-purpose these places. I am sure that many will try turning them into up-scale apartments/condos. Which will be at great cost and effort, because they were not designed with this use in mind. Further, rental rates are going to crash.

Basically, commercial real estate is going to crash and take down the mid-sized banks with it.

Suburban Housing is Toast

The things keeping housing prices high is lack of inventory and mortgages. Unfortunately, demographics say this has ended. The largest generation, who owns 25% of all houses, will be leaving them empty soon.

Also things like people fleeing cities, illegal immigrants being driven to the border, and "died suddenly" continuing to increase, is going to leave even more houses empty. Food riots, rising crime, lack of jobs, and lack of stores are going to make even more people flee the city.

And then, the small-bank failures start racking up, leaving very few sources for mortgages. And those left to give out mortgages are going to demand higher and higher qualification.

So, housing is going to need to come down A LOT to get them to sell. People who are trying to sell right now, are already offering 10% discounts. This is going to need to increase to 50% discounts before things will start selling again. But, by that time, there will be two houses for every house buyer. And the price will drop to zero over time.

Vast tracts of suburban houses will be left vacant.

Rental Properties are toast

Places, like Comifornia are leading the way into "socializing" housing. Already it is hard to kick out a non-paying tenant. It is almost impossible to collect back rent and/or repair costs. And now, some states are putting rent rate caps.

Add this to rising insurance rates, many landlords are finding themselves underwater. Losing money on their rentals. (they can't raise rents because of rules and competition) And once that happens, they have to sell the properties at a loss, because no one will buy a non-cash-flowing property. So, either the landlord takes a loss, or the bank takes a loss.

People leaving the cities makes this even worse. Less people who want or need to rent. And, at some point, people will just move into abandoned/empty houses.

Landlords also face higher costs to refinance. Basically, if you are not hugely in the green (because you bought the rental long ago) you are going to find yourself squeezed out of the market.

Neo-liberals already hate landlords, saying that they are not doing anything to earn the rent they are charging. So, if you are renting a house in a blue city, sell it now at whatever price you can get. It will be even harder soon, until you can't give them away. Neo-liberals will start really disregarding property rights. And if that doesn't happen, the blue states/cities are going to take over the rentals, and socialize housing.

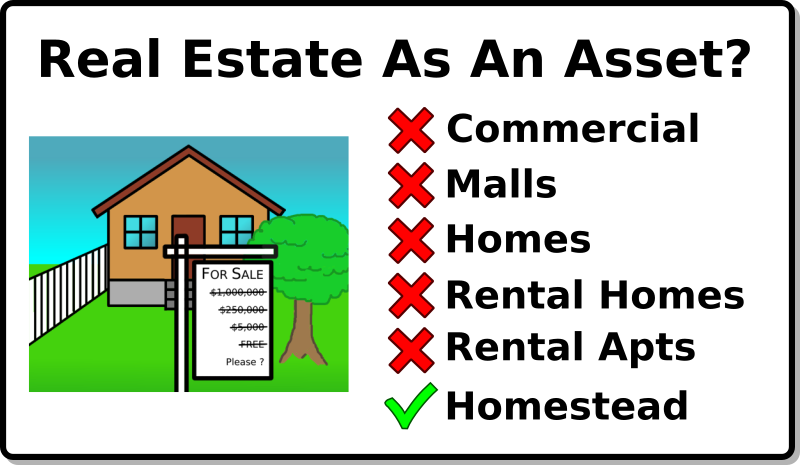

The idea of using real estate as an investment is over.

All of these coming economic and banking changes are going to make real estate investing unprofitable, but before things balance out, we will change how we handle real estate. There won't be any.

No "kings estate", no property taxes, and the rules for property "ownership" will change greatly. There will not be anyone selling property, and no one to sell it to. And no banks to juice the system so that buying/selling is seen as profitable.

Your property will be where you and your family / tribe / small community live, exist, grow children, grow food.

I suggest you all get out of the real estate market. And start thinking of your house as the place you live, not a an investment. Start making future calculations of whether a property is worth purchasing, based on only its liveability.

Get out of the real estate market, and start looking for your tribe and your homestead.

Comments