Will Compute Be The Most Valuable Commodity In The Future?

0 comments

Sam Altman, the CEO of OpenAI, made the case in a recent interview that compute power could be one of the most valuable resources in the future. Could it be that computational resources will be worth more than gold, oil, and diamonds?

In this article, we are going to discuss the concept of decentralized compute networks, why compute is such an important commodity, and outline a few specific DePIN projects that may be worth further research.

https://x.com/Zowae_/status/1787576094599811124

What is Compute?

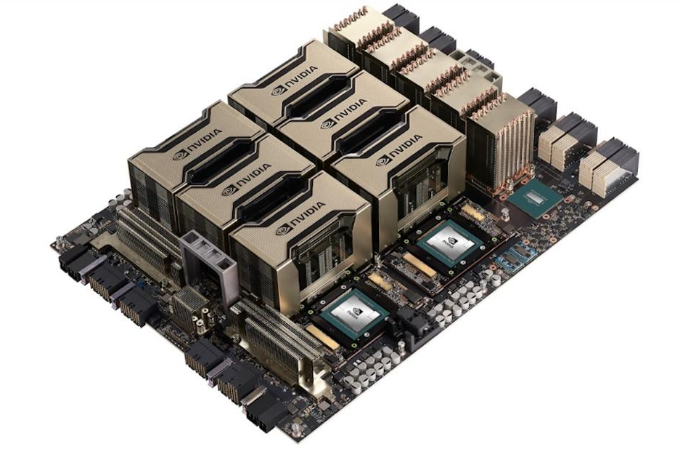

When we refer to "compute" we are essentially referring to graphics processing units (GPUs) that are capable of rendering images and video, as well as the servers that power today's modern data centers.

Most of the Web 2.0 services we use today such as Google, YouTube, Facebook, and Instagram are all hosted on servers located in data centers around the world.

Imagine if these data centers were to be split up, such that the compute power that was once under the control of Big Tech corporations is divvied up among new owners, and traded based on a decentralized token economy.

The idea being that people or businesses who have spare compute power in the form of GPUs or servers can connect their equipment to a decentralized network, and earn fees for providing compute resources to buyers in an open marketplace.

Artificial Intelligence

In addition to data centers, compute is the primary resource that powers Artificial Intelligence (AI). Large Language Models (such as ChatGPT), as well as text-to-image and text-to-video generation all require massive compute resources, and we can assume there will be an increasing demand for these services as we move into an AI-powered future.

There are already plenty of blockchain projects that are innovating atop the experimental tech behind Bitcoin and Ethereum to develop token-based economies for compute resources, and if compute is likely to be one of the most in-demand commodities of the future, we should at least do a little research on these projects.

Render Network

The Render Network (RNDR) is a decentralized grid of GPUs that allows anyone with spare compute power to lend their equipment to the network and earn RNDR tokens. Production studios and independent artists who need to render images and frames for their projects consume the network's resources.

Render recently migrated their token from Ethereum to Solana, ostensibly to save on gas fees and increase transaction speeds.

Nosana Network

The Nosana Network (NOS) is another decentralized compute grid built on the Solana blockchain. Participants who lend their GPUs to the network can earn the NOS token for providing compute resources.

Both RNDR and NOS can be purchased using the built-in decentralized exchange (DEX) in the Phantom wallet, which you can install on your smartphone as an app, or as an extension in your web browser. Always remember to safeguard your seed phrases when generating a new wallet.

Akash

Unlike Solana-based Render and Nosana, Akash is its own blockchain in the Cosmos ecosystem, and it allows anyone to buy and sell compute resources using the AKT token. Users can rent Virtual Private Servers on the network using the token, a cryptocurrency that can be obtained via the Cosmos-based DEX Osmosis.

CUDOS

Also launched within the Cosmos ecosystem, CUDOS is another project working to decentralize data centers. Similar to Akash, the CUDOS token can be purchased using the Osmosis DEX.

We need to consider that the initial token distribution of CUDOS and other DePIN projects could be detrimental to their long-term success. That said, the community could always fork the blockchain away from the founders and venture capitalists at some point in the future.

Along with the networks covered above, it may be worth looking into iExec (RLC) and Flux (FLUX), which are also working to decentralize the world's compute resources.

Money Of The Future

The aforementioned cryptocurrencies, along with other DePIN tokens that have real-world utility, could very well end up being the money of the future. When the US dollar and other fiat currencies collapse under the weight of their own debt, people will no longer be betting on the USD price of Bitcoin, but rather be using censorship-resistant tokens that have real-world utility.

If you learned something from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...

Comments