Changing strategy after TribalDex stopped incentivizing pools

5 comments

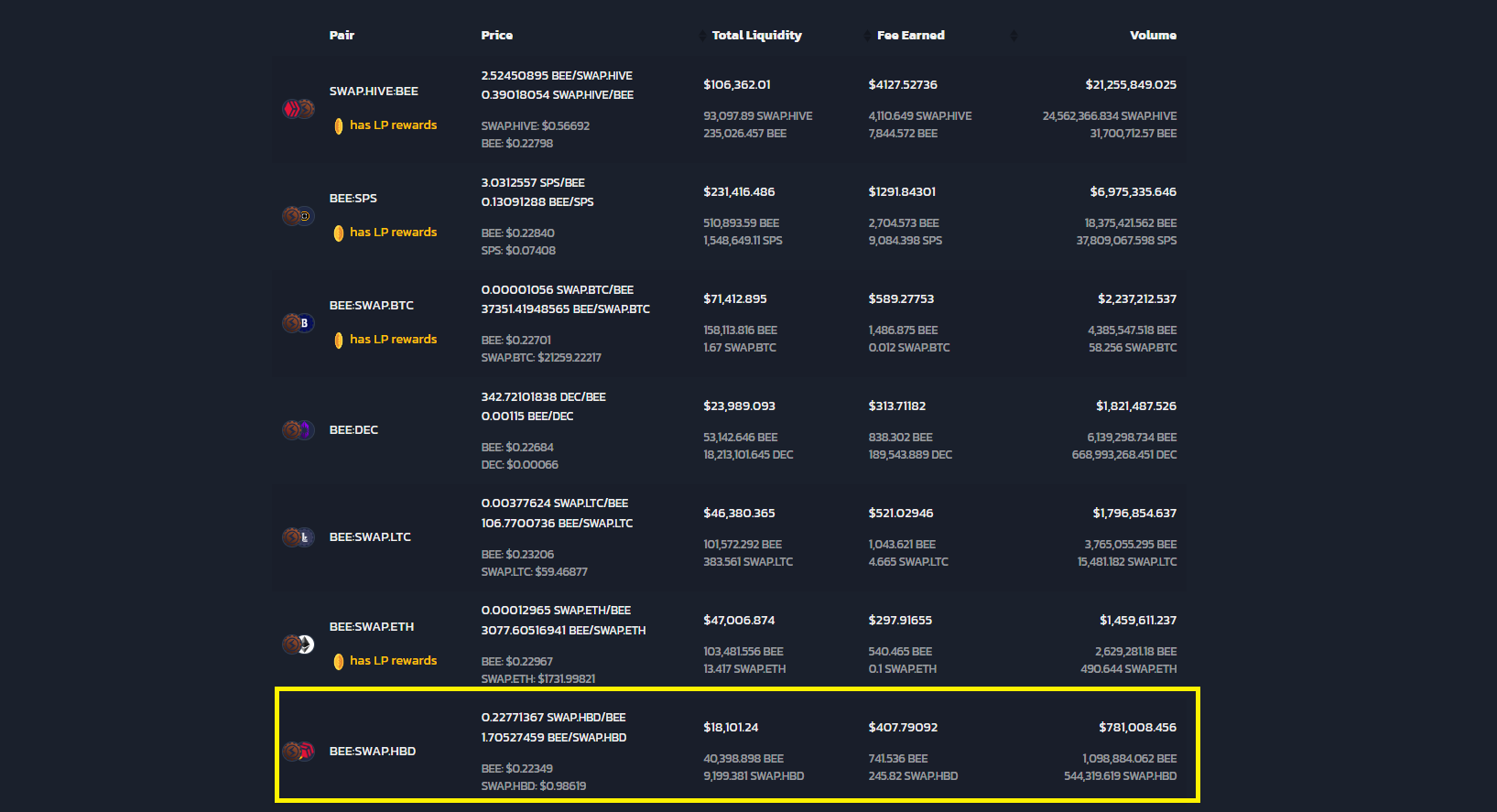

TribalDex brought Liquidity Pools to the Hive blockchain ecosystem in a modern way and up to industry practices and requirements. Launched about 1 year ago or so, it provided BEE tokens incentives for establishing various pools and created a new breed of Liquidity Providers that gathered funds, bought more, and added paired tokens to support these pools. But it seems that the party is over and some pools dried the 1 year (365 days) funds allocation. And as these will not be incentivized anymore, I think it is a good time as ever to change strategies.

I was in the BEE:HBD pool for almost 1 year and I got some sweet returns on that with an APR of around 100%. Not sure if I recouped my investment or not as I didn't track the entry/exit amounts, nor the fact that the BEE token decreased in value from my initial participation. Probably I could have redirected my funds to a different pool like BEE:HIVE which has the rewards end in 283 days, but I've already liquidated my position and moved everything into HBD Savings where anyhow I think I get a bigger reward.

So what is my strategy now? Well, the strategy is to gather new BEE tokens from content creation and curation on TribalDex and built a strong wallet to ensure future gains. I was on this slope before and it seems that I am returning to it. Will not be easy starting near 0 BEE tokens, but such challenges simply bring real motivation and focus.

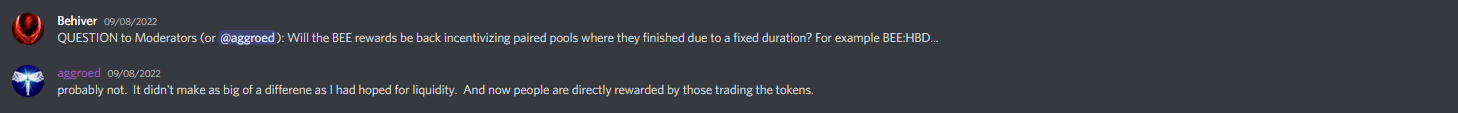

While I was disappointed in seeing a pool containing a stablecoin (HBD) and the Hive Engine token (BEE) not being supported anymore by the @aggroed team (and still do not agree with it) and as I see that other pools have happened the same, I think that this might create a bit more scarcity to the BEE token and improve its price. Thus, moving back to earning from blogging might be a good move. Let's see if that comes to fruition!

Posted Using LeoFinance Beta

Comments