All The Moneys . Trading Journal Project # 2 . April 27 - 29

0 comments

Tuesday 6am, April 27 2021. Los Angeles

Tastyworks . Robinhood . Oanda FX . Voyager Digitals

Thank you for today. Gracia familia.

.

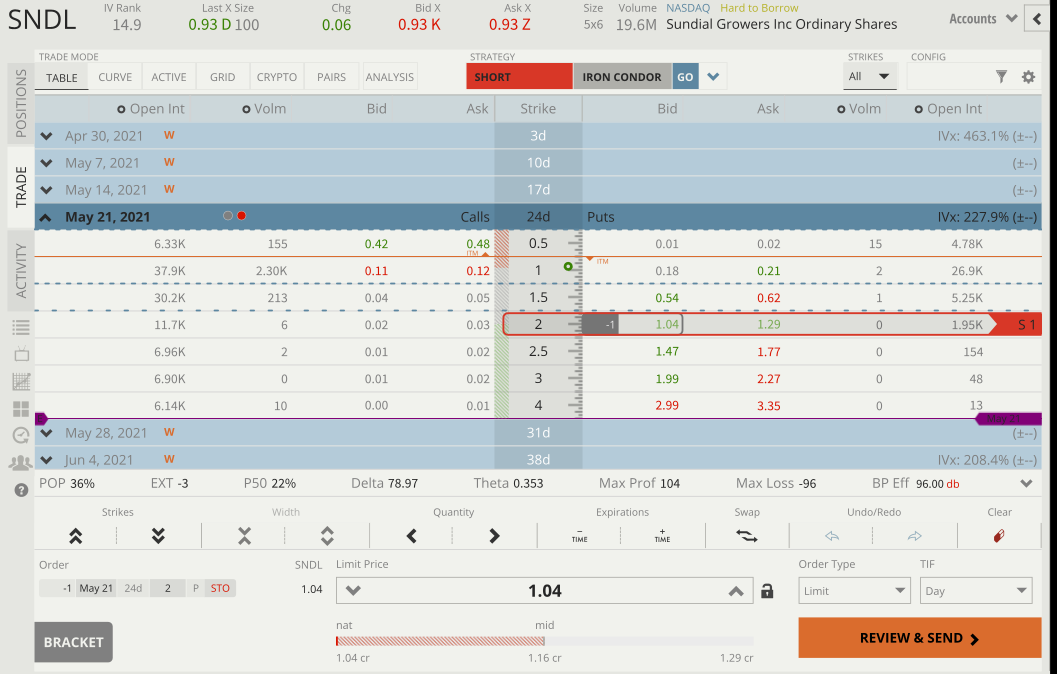

Opening Bell observations. SNDL premium shot up. There was a blip on there where my short put's premium looked to have quadrupled. That tells me that one strategy would have been to set a bid at 4.00 on the 2 strike which is currently at 1.04. Who knew? Someone knew. Interesting strategy.

.

10:23am #AMC IVR is only a 9, which is keeping me from shorting at these levels on the chart. Keeping an eye on it with alert set on AMC.IVR 16%.

NOTE . Tastyworks show with Vonetta mentioned something about IVR going to be relatively low overall for things because that big move from last year still needs to unwind in the overall average. Tuesday

April 26, 2022 is 52 weeks from today and sounded like some fella was suggesting ivr in the spx would remain relatively low over the next year barring any jolting events.

NOTE . I"m trying to place option trades around opening and close. Part discipline and part strategy.

.

11:12am

Voyager

DOGE

CKB

GLB

EOS

ENJ

XVG

VET

HBAR

STMX

ADA

BTT

.

now only

DOGE

EOS

ENJ

ADA

BTT

.

NOTE . Digital timeframes in comparison to legacy markets: I feel the 6 hour on digitals is similar to the daily for stocks. And stocks daily are like FOREX weeklies. Vague unthought out thought.

Tuesday 6am, April 28 2021. Los Angeles

Tastyworks . Robinhood . Oanda FX . Voyager Digitals

Thank you for today. Gracia Familia.

.

Being consistent with journaling is not easy. I'd prefer to go with the flow and jot things down on the notebook. Just a note that despite not writing at all times, I'm still listening to Tastytrade over all else. I like the Atlas Trading discord trading room. And trying to ween myself off the addiction to twitter.

I feel duped into buying SFX on Small Exchange. I can't explain my bullish bias for Dollar any more than the DXY chart looks bullish to me. Bullish last few months. This retrace is dramatic, but I still think it could be headed higher as global uncertainties and equity all time highs continue to build.

DXY monthly

.

11:55am

SFX

bought 1 around 144.1 . I think SFX resembles USDCAD most so far.

FOREX

Took off losing positions in EU, GU, UCad. Big losses.

Bought GU. Bought EU. Bought ACad.

PLUG

Set alert for Price at $30.

RKT

Set alert for Price at 23.39.

.

NOTE : If buying stocks or crypto again, the goal is to have 1000 shares or 200 minimum.

.

Wednesday 6am, April 29 2021. Los Angeles

Thank you for today. Gracia Familia.

.

6:55am

DXY . 6h Daily Monthly . I see trendlines. Many monthly tops and bottoms in the range we're in.

.

6:59

Tastyportfolio : Slaughtered in UVXY. Turning around in SFX. RKT and PLUG bullish move today is in my favor. Still debating when do dump some stock and go straight to options or if hold going into new year. Possible dips later in the year where others front run end of year profit taking. I think that is something I'll look for in August or September.

AYRO is an example of the conundrum. I like the stock. But the options are dry. I appreciate liquidity now. I'm learning more as I go down the options rabbit hole. I can't articulate half of it, but it's general mechanics have finally started to click over the past year. Takes time is all. Like options! And like AYRO, it takes time. The benefit with liquid options is that I can benefit from that time. What i notice is how dry the volume is on AYRO. Some open interest, but in general very low volume. In general 130K on the day, ouch. So in the meantime I sit on my hands while the EV sector consolidates. If I was working a great dayjob I liked, I might understand a strategy that dollar cost averages into shares with the cashflow. Eventually with a dayjob I could incorporate short puts into a long position, buy some puts or sell some calls along the way when price is extreme, but ultimately collect profits off the short put premium.

Cause at the end of the day, I AM THE STOCK. I want my number to go up. It's not as important if AYRO stock goes up, I'm trying to give myself the best opportunity to appreciate over time as possible.

.

7:30am

FOREX. I'm fighting my ego. It's all over the place. I need to just stick to what works. I get influenced by chats. Suddenly someone is trading EURNZD or GBPAUD and I feel inclined to check it out. Above else is my bullish Dollar bias. How bad can it get? DXY 90.711 , a dime down on value. I don't know how this is supposed to be a good thing for anything. I go to the store and my can a pepsi went up a nickel. That's where I draw the line. I want a stronger dollar. OK, i know what my ego wants. I'm trying to either tame it or obey it. We'll see. So far it slaughters me in FOREX. I've lost it all and held enough steady to keep hope alive. I see the tremendous potential to incorporating fundamentals and technicals. It moves different than stocks and digitals.

8:14am

FOREX

GBPJPY . shorted 151.95

.

8:57am

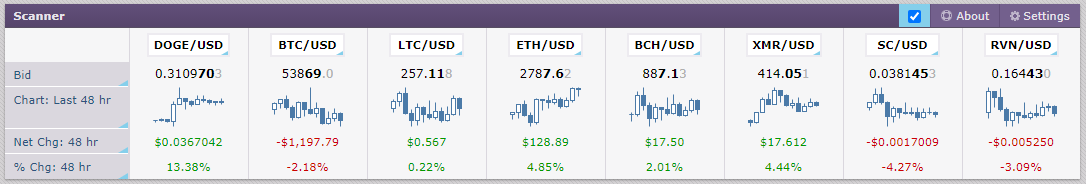

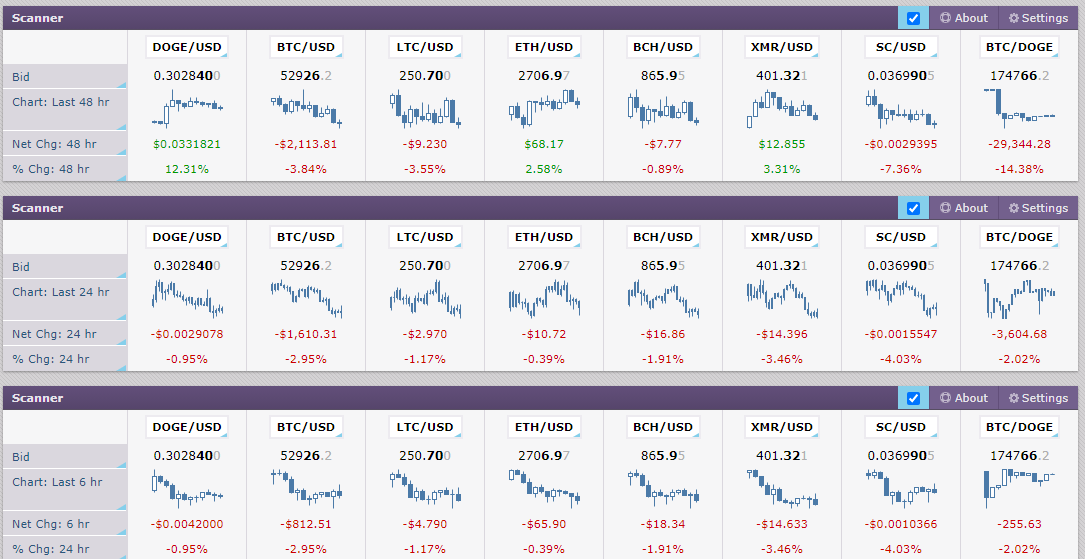

CRYPTO snapshot via cryptocraft.com.

.

9:19am

DXY & DOGE . 1 hour . Interesting to see a correlation and a decoupling. But in general, I think DOGE might be worth watching along with Dollar because the moves could become dramatic regardless of direction.

I'm not sure what you mean. But I noticed that there was a strong price reaction. One was corelated and the other was not. Never the less, the price moved with conviction. I'm sure there's other assets that had similar moves at those timeframes, but I'm only looking at DOGE and DXY and sharing. As far as direction.... Call me nuts, but I think they are going to move together. I could soooo be wrong. But i think that DOGE and DXY are going to start moving together. I think some monkey business is gonna happen in MAY and AUG. OR I think some monkey business gonna happen with the Maricopa County Voting Count, or with the Evergiven, maybe something "rona" related, maybe a wacky headline fud on Tether or another Oil Dump*, SP500 is at already at bonkers highs, or who knows what the MSM & FBI can come up with.... But something could happen and when something happens, DOLLAR is KING and GOLD is GOD. But Doge is soooo liquid, there's soooo much of it, that if it gets flooded with volume it could act as another safehaven.

Name a Crypto, whose logo is not a shape or a letter, and who has been wrapped on NASCAR, has a professional baseball team named after it, has brands using it in their business calls, is being kept on the books of Mark Cuban like Michael Saylor hodl's btc, is accepted by NBA teams, rumored to be accepted eventually by Amazon & Petsmart, whose name subliminally is the same as the leader of the longest running Republic and BIRTHPLACE of Western Money! In simpleton terms: their logo is a shiba in adorable puppy. D O G E

.

Just taking a peak at Bilderbergmeetings.org 2019 participants. Putting together some kind of a tracking index. So, longterm I want to put together an index to track Bilderbergmeetings.org. I was doing some DD and the names and entities are interesting. I'm going to start with 2019 participants and look back over the past 5 & 10 years and find the recurring characters. Eventually end up with 3Bilderberg INDICES that track A Most recent participants B Participants that have attended more than 3 times in the past 10 years. C Participants that attended twice in the past 5 years. Eventually I'll add 2 more D, tracking the past 25 years worth of regular attendees and E tracking the most regular entities since 1954. til then, here's a sample of names :

.

11:11am

Added to FOREX account. I mentioned I took off some losers recently.

.

1pm

Closing Bell

Daily PL down. Most of it stonk, which doesn't bother me. I'm watching PLUG, RKT, SNDL, SFX, and UVXY.

However I'm committing trading's cardinal sins with each of them:

- Do not add to loosing positions,

- Never bet against the Fed knowing or unknowingly,

- Never buy volatility,

- Do not make dumb trades.

.

1:30pm

Dear Market Jesus, who art in Chicago, let my hell end & get me out of these trades. I promise never to long dollar or buy volatility. Just let me break even & I swear I'll get flat. And I promise never to listen to the Soz when he says he's nibbling at something ever again. Amen

1:50pm

Crypto Update, taking in the view.

2:15pm

#DOGE $0.30 cents

.19

.25

.27

.29

<---bears . buy

bull . sell--->

.70

1.10

1.50

1.76

.

OK!

That's a good enough place to stop. This is a project in progress and as long as I'm moving forward then I'm moving towards my goals. Usually I'm just winging it with a notebook, but I'm intending to bring some more structure to the process so I can articulate the opportunity to family and friends. Wishing Ya'll all the best always.

#allthemoneys

2:22pm

Posted Using LeoFinance Beta

Comments